Over this past weekend, a client sent an article asking if a market crash was coming. As this end is touted by many pundits and financial prognosticators, I thought I would share my response below.

Dear Client:

Should I place all honor and ethical compulsion aside, I would certainly become a doomsayer economist and/or snake oil financial salesman as it is easy to prey upon an investor’s basest instinct and sell fear to make a fortune. I would make the same argument for anyone who sells market timing services as I (like Warren Buffett) believe it is an impossibility to time if/when corrections will occur over any period of time. This is especially true as one has to get the timing correct at both the bottom and top. For quick examples, one may also reference my blog posts “The Futility of Stop Losses and Excessive Trading” and “Do Market Timing Strategy Products Work” as examples.

Now to the crux of your question namely is the U.S. market overvalued. My answer: possibly. I’ve written a great deal about this in many of my past newsletters posted on our website. Unlike the article advising to sell everything, our research contains detailed economic and scenario analysis. Certainly those calling for a correction have been terribly wrong and their hedge funds which have shorted the U.S. market have paid dearly and lost their clients billions…literally. Importantly, though I believe the overall U.S. market to be somewhat overvalued, our U.S. stocks are selling at just 14.6 times trailing earnings and international stocks at just 13.9 times – both of which are below historical averages for stocks over the past hundred years. Thus, though the overall U.S. market (S&P 500) may be overvalued, I don’t believe our U.S. stocks, nor the international market, is overvalued at this time.

Now, will those calling for a correction eventually be proven correct? Of course, at some point they will as even a broken clock is correct twice a day and eventually we will have a larger correction than the many ~ 10% corrections we have had since 2009. The larger question is will it occur soon and should one remain on the sidelines and/or attempt to time this correction. My answer to that question is that those who have tried to time a correction and/or sat on the sidelines in cash (or worse have been short the market) have paid dearly in opportunity cost over the past eight years and will likely pay going forward also. Of note, even those who fretted an Obama Presidency as the end of capitalism have missed a 164% return (though our U.S. stock strategy – the Disciplined Alpha Dividend strategy has performed even better at an approximate 200% cumulative return during that same period).

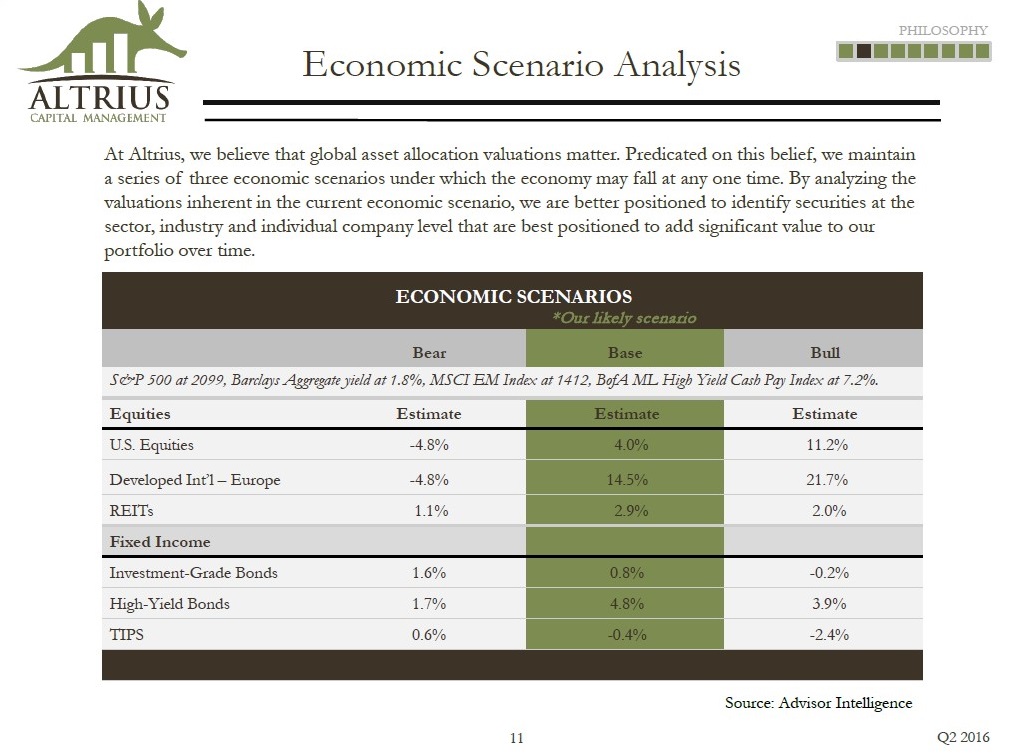

As we model for a worst case scenario, the doomsayers could be correct and stocks (both U.S. and international) could lose 25% over the next five years (see scenario analysis below). However, I place this possibility as a lower one (< 15%) than our base case scenario which displays just middle single digit returns for U.S. stocks (again as value managers our stocks in your and my portfolio are much cheaper than the growth stocks pushing the broader S&P 500 to higher multiples). You’ll notice that high yield bonds provide sound returns under all three scenarios which is why I believe investing in high yield bonds at this time is an important aspect of a diversified portfolio.

In conclusion, it is certainly easy to call for the end times in order to attract attention. It is far harder to prudently manage assets, invest side by side our clients, determine an asset allocation among various asset classes in a balanced portfolio and select individual stocks and bonds to produce steady income and total return for our clients. Our 13+ year track record is on our website for the world to see (and ranks among some of the best) whereas the author’s is nowhere to be found on their website.

Wish I could answer a simple question with a simple answer, but economics, investing and life are not that simple. Have a great weekend!

With warmest regards,

Jim