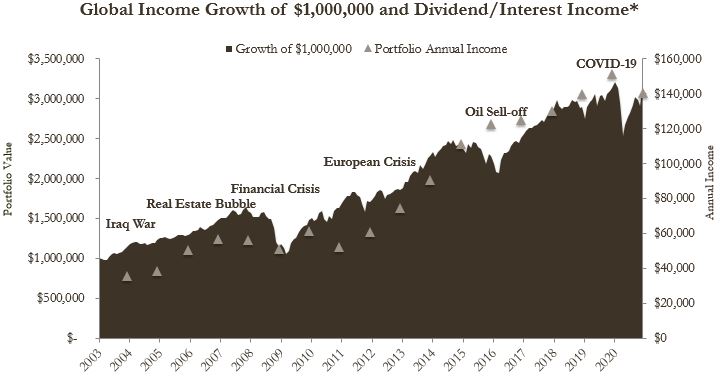

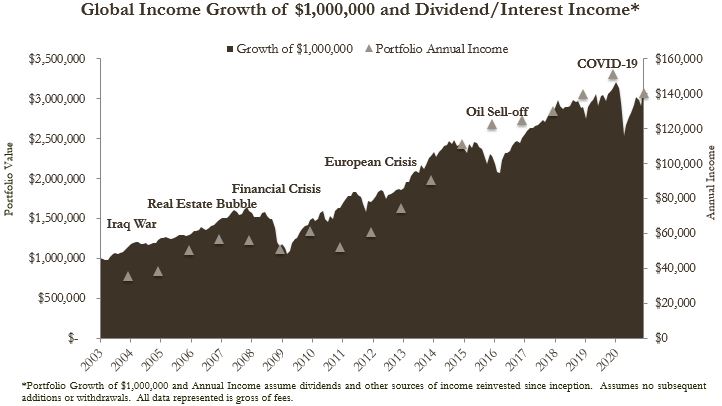

Clients familiar with our investment philosophy understand and appreciate our income-focused, value-driven approach. Many of you may recognize the first chart below, which highlights this approach since the inception of our flagship Global Income strategy in 2003. The portfolio values of our clients certainly fluctuated over the past two decades particularly during the dramatic sell-offs resulting from the Great Financial Crisis of 2008, the oil market sell-off of 2014, and recently the COVID-19 recession. However, despite these fluctuations, our clients have enjoyed a steady and growing stream of income over the past 18 years, as the chart depicts.

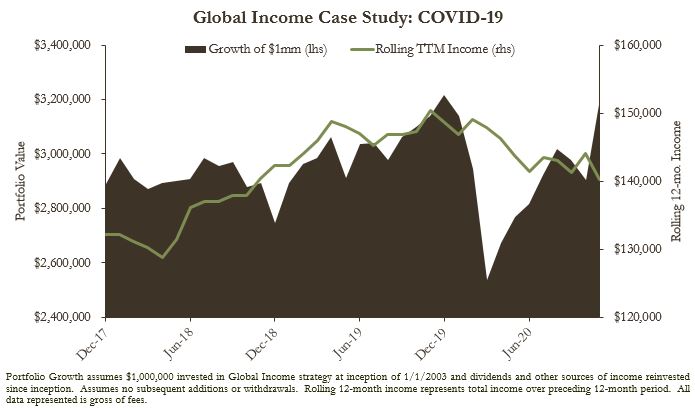

This time is no different. We can zoom in on the COVID-19 recession to demonstrate this more clearly. The dramatic equity sell-off in March was enough to spook even the most disciplined investor. However, a 20% dip in portfolio value was accompanied by hardly a budge in real income generation, as shown below. Despite the unprecedented volatility at the end of the first quarter of 2020, our clients continued to earn steady income through the period. Such is the merit of an income-focused strategy.

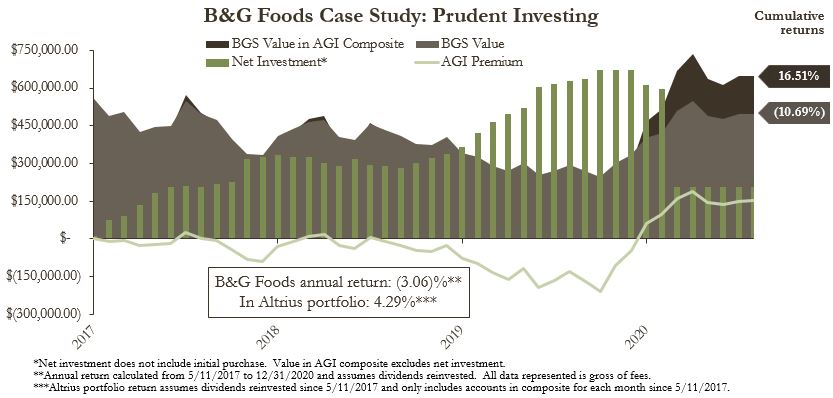

To drive these points home with an individual holding case study, we can look to B&G Foods, a holding company of branded foods such as Green Giant, Ortega, and SnackWell’s. We initially purchased the company on May 11th, 2017, when it traded at $40.45 per share. On December 31st, 2020, the price closed at $27.73 – a decline of 31.4%. Yet, our clients have earned an annualized return of 4.29% over these three and a half years. How can that be? By steadily collecting and reinvesting dividends and adding to our position as the stock price fell below $13 per share, we not only earned our clients reliable income, but also generated capital appreciation as the stock began to rebound in 2020.

Investing requires a levelheaded discipline to stay the course even when things aren’t moving your way. We held losses on B&G Foods – a solid company with consistent cash flows and reliable dividends – for the better part of three years as the stock trended lower. Still, we added gradually to the position over this horizon, and have been paid handsomely for our patience.

2020 proved to be a turbulent and challenging year for many, notwithstanding the whipsawing volatility in financial markets. We are proud that in spite of these conditions, our clients were not faced with a sudden loss in income due to the ongoing recession. We continue to be grateful for the trust our clients have placed in our firm. As always, we are available to answer questions about our investment strategy or to aid you in your financial planning needs.