“The investor’s chief problem—and even his worst enemy—is likely to be himself.”

– Benjamin Graham

Since President Trump’s April 2nd “Liberation Day” announcement, financial markets have exhibited significant volatility, understandably causing consternation among investors. The initial draft of this post was finished after market close on Tuesday, April 8th, having witnessed the S&P 500 fall 12% and the tech-heavy NASDAQ drop more than 13% over the four preceding trading days since the announcement. The MSCI EAFE – an index of developed international equities – had fared only marginally better, shedding 11% over the same period. The very next day, each index nearly recouped the entirety of those losses over a single trading session, with the S&P rallying over 9% and the NASDAQ gaining 12%, spurred on by positive news on the tariff front. Where do markets go from here? More importantly, how should you respond?

We’d direct clients to our Q1 2025 Portfolio and Economic Commentary distributed this week, in which we address these questions directly and provide a detailed discussion of our investment outlook and portfolio positioning. The short answer to the first question is that the future direction of travel is truly anyone’s guess. The rapid rally witnessed on Wednesday may prove durable if bilateral trade deals are reached over the next 90 days and/or the administration softens its stance. The inverse could instead come to pass if tensions are ratcheted back up and trade partners choose (or are politically compelled to pursue) a retaliatory path, leading to escalation and a potential revival of the selloff that began last week.

However, the second question has a much more straightforward answer for investors: the best response is to remain patient, take a long-term perspective, and stay the course. Short-term volatility is an inherent feature of long-term investing, and an indisputable insight of behavioral finance is that emotional reactions to short-term market swings lead to irrational trading decisions and suboptimal returns. The independent research firm DALBAR runs an ongoing study of investor behavior, evaluating how the average equity and fixed income investor performs against the broader market. It should surprise few that the average equity investor underperformed the S&P 500 by 5.5% in 2023 and the average fixed income investor underperformed the Bloomberg Barclays Aggregate Bond Index by 2.6%. Results were no more flattering for the average investor in either 2021 (a strong year for equities) or 2022 (a particularly painful year for investors). What drives the divergence in outcomes across market cycles? In their desire to perfectly time the market, investors have a destructive tendency to sell out of positions during downturns and as a result, they miss out on rebounds. Indeed, Burton Malkiel – a widely respected economist and author of A Random Walk Down Wall Street (on our reading list, by the way) – identifies this tendency as investors’ most serious mistake.

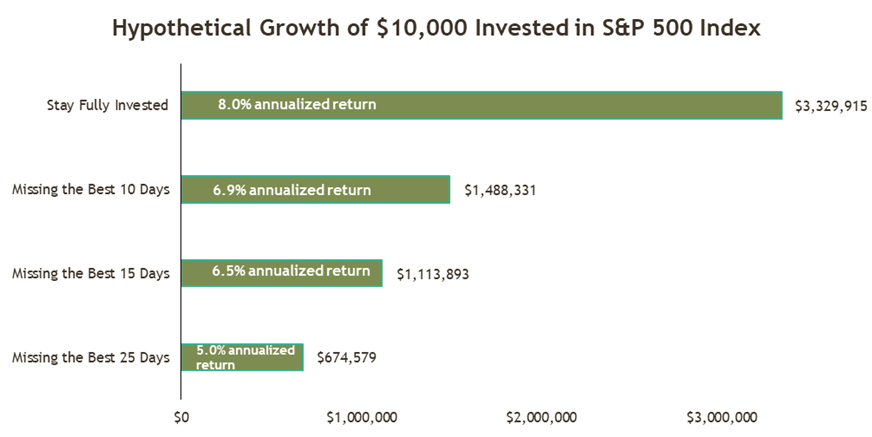

Sometimes the reason that many intelligent minds agree on a result is because that result is nearly irrefutable. The folly of market timing presents one such case. As the below chart shows, while it can be painful to endure stock market declines, it has been much more painful over the long haul for investors to panic sell during times of volatility, thereby sidelining themselves during the rebounds that follow. An investor who missed out on the 10 best trading days since 1950, many of which came immediately following or even between large declines, have forfeited over 1 percentage point of annualized returns. That difference compounds tremendously over a long investment horizon and thus the adage continues to ring true that “time in the market beats timing the market.”

As Jim has cautioned investors both in this blog and in his book Invest Like an Aardvark, oftentimes the most prudent action an investor can take in a moment of high uncertainty is to “sit on your hands and think.” There is always a reason for anxiety about the state of the markets – presidential elections, government shutdowns, a global pandemic, trade uncertainty, the list goes on – and there will always exist those who claim to have clairvoyance. The reality is that nobody knows with certainty how crises (either real or perceived) will play out and how markets may react in the short term. This is why we believe it is important to remain disciplined and avoid making reactive portfolio shifts to near-term events. It is times such as these that reinforce the importance of diversification, patience, and our time-tested, value-driven, income-focused investment process. As we’ve written previously, even when portfolio values decline, our clients are “paid to wait” and continue to receive reliable income from the high-quality businesses we invest in. It is in large part due to this steady income generation that none of our retiree clients have needed to return to work in Altrius’ 28-year history.

While the current market environment is noisy, as a long-term investor it is crucial to remain disciplined and avoid making emotional investment decisions. Our prudent investment approach is designed to support our clients’ needs and financial goals through participating in rising markets, performing in sideways markets, and protecting by providing income in declining markets. This mission has earned us the trust of our valued clients over the past 28 years and we promise that this objective will always drive our decision-making process.

We appreciate your continued trust and encourage you to reach out with any questions or concerns regarding your investment strategy or to schedule an introductory meeting with an advisor.