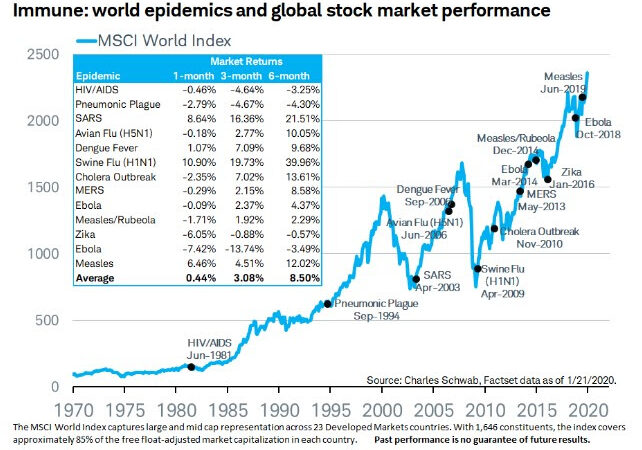

With the coronavirus spreading panic and a market selloff over the last week, some are wondering how we should position our portfolios in light of a potential epidemic. As is usual under such circumstances, I prefer to take an historical perspective. Though history doesn’t repeat itself, it certainly does rhyme and may give us a sound guide of how to proceed going forward. As such, I’ve attached a chart below which illustrates how the market has responded during the onset of other infectious diseases including SARS, Ebola and Avian Flu among others. Though such epidemics may certainly have an impact on the broader economy and market over the short term, you’ll notice that over longer periods of time, the stock market has been “immune” to broader damaging effects.

The severity of the virus’ impact will ultimately dictate the depth of a market selloff. That the coronavirus comes during the Lunar New Year when Asia tends to see peak travel and consumer spending may also exacerbate the potential economic and market data. Further, it is possible that the coronavirus spread quickly beyond China causing broader economic damage.

Therefore, we will continue to monitor the situation closely. However, we will not act in a knee-jerk manner and will continue to make decisions based upon the fundamentals of corporate earnings and economic indicators as delineated in our recent newsletter and economic presentation.

I always prefer to think of our investments as buying a piece of a business rather than as a stock certificate to be traded intraday based upon some piece of information outside of our control. It is important to understand that we are buying a portion of Ford, Apple or Starbucks and we are likely to hold that business for the long term unless the valuation becomes untenable. I would rather trust in the more reliable guides of a long term perspective and valuations, than short term news which can precipitate ill advised trading often leading to being whipsawed and harming returns and performance over time.

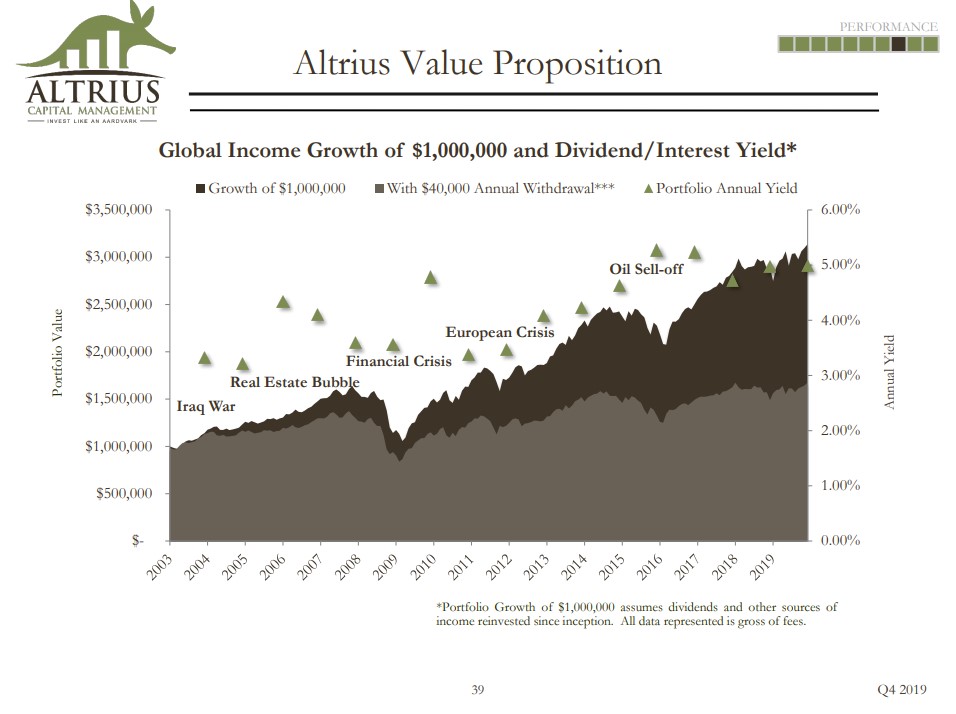

Of course, an additional benefit of our process at Altrius is that we receive the satisfaction of regular income in the form of dividends and interest from the companies we own. Despite all the turmoil of the past 23 years since I founded Altrius, none of our retiree clients had to go back to work. They just kept collecting their income during whatever crisis we suffered through (which were numerous over the past two tumultuous decades).

The primary reason our clients never had to go back to work is the 4% – 5% income stream produced by their balanced stock/bond portfolio (see chart below excerpted from page 39 of our Global Income presentation). In contrast, the current environment of passive/alternative/ETF/mutual fund strategies utilized by the majority of advisors produces little income and incurs only the hope for price appreciation to fund existing or future retirements.

As always, should you have any questions regarding our economic outlook, investment strategy or your personal financial circumstances, please don’t hesitate to contact us. We appreciate your continued trust and confidence.