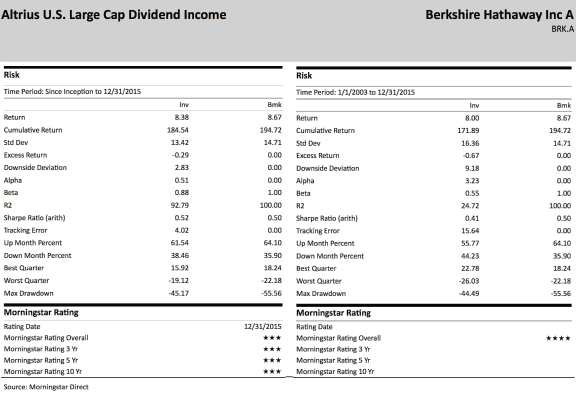

Many consider Warren Buffett to be the world’s greatest investment mind and successful investor. However, since our firm’s recorded performance track record dating back to January 1, 2003, our U.S. Large Cap Dividend Income strategy has outpaced Berkshire Hathaway with less risk as measured by standard deviation.

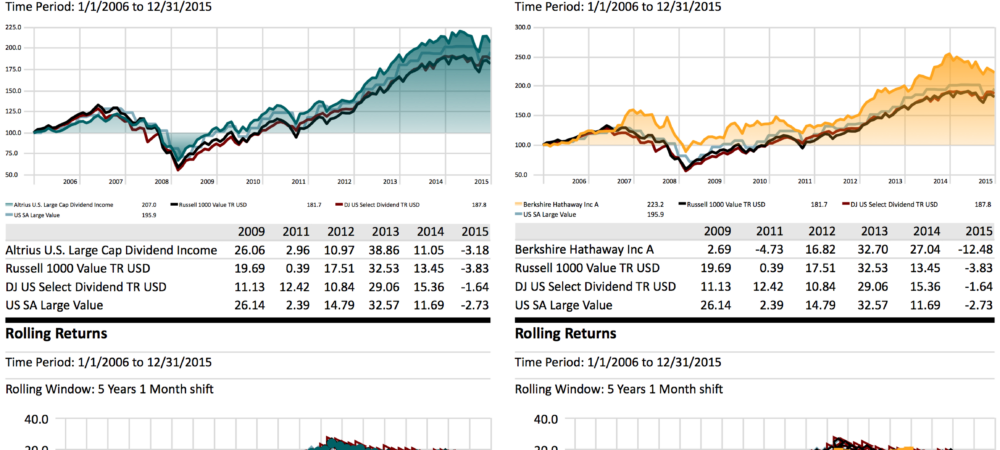

Though we haven’t outperformed Buffett by much over the past thirteen years gaining 8.38% or 184.54% cumulatively through December 31, 2015 to Berkshire Hathaway’s 8% or 171.89% returns (and have slightly underperformed after our fees), our returns display that we have performed exceptionally well over the past decade plus providing sound risk adjusted returns to our clients.

We don’t of course believe it is prudent to invest all of one’s assets in U.S. stocks as it is important to also purchase bonds and invest in international companies to better diversify one’s portfolio. It is also important to remember that even the great Warren Buffett has experienced losses during many years of his long career thus illustrating the importance of patience during recessionary periods and inevitable market declines.