The Following is in Response to a Panicked Email From a Client and Contains Valuable Information For All Long Term Investors:

Dear Client,

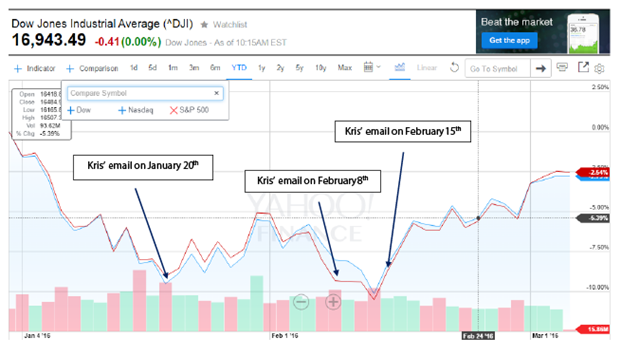

I know Tara mentioned the timing of your concerned emails this year, but I wanted to display it graphically (see below and attached chart) as I believe it better illustrates the point that one cannot time the market and should not concern themselves with day-to-day volatility. The timing of your emails came almost exactly of the bottom of the stock market declines this year and subsequently directly before significant rallies. In reality, when you “felt” most nervous, we should have been investing more. This is counterintuitive, but is a mantra for long term value investors as expressed in Benjamin Graham’s (Warren Buffett’s professor at Columbia) quote below:

I of course don’t know if stock and/or high yield bond prices (which have also rallied) will continue to rise in the coming year – and frankly don’t concern myself with such short term moves. In order to improve your potential success as an investor, I would recommend not looking at prices on a daily, monthly, quarterly or even annual basis. Instead, understand that though our stock and bond prices will fluctuate, your income from dividends and interest will generally remain relatively stable enabling you to utilize the income to potentially fund your retirement income needs or reinvest them in order to purchase more shares.

Just as you and I don’t look at the daily prices of our businesses, I would recommend not looking at the daily prices of stocks and high yield bonds. Rather, just as we collect a salary from our businesses, we may collect income from the stocks and bonds in which we are investing.

Have a great weekend and please don’t hesitate to call or email should you have any questions regarding your wealth management or investment needs.

With warmest regards,

Jim

Client reply:

I did. I added to my personal positions a little at a time on the way down to about the time I sent those emails. Up just under 2% ytd. Not very good but beating benchmarks so far.

As you know, you have a large part of our retirement funds that we have entrusted to you to manage. I get concerned when I see portfolio valuations drop… Yes we had dividends and interest but we have to pay taxes on that money which is not factored in on the performance reports. Our bond positions are doing horrendous…There are some bond picks that have me scratching my head but I do not have access to the info your monkey throwing the darts has. I believe your stock positions are good for the most part and as oil recovers most of them should recover. The overall yields are good as long as the companies stay solvent.

Markets have seemed to stabilize lately. It was a bad start to the year but things appear to be getting better. I imagine that with an election year and especially with our choices of candidates we will see more volatility. I can tell you one thing, If Bernie is the democratic nominee, I am likely going to cash until after the election.

Jim’s reply:

A few thoughts in reply to your comments/concerns:

1.) You are correct in that I am the monkey “throwing the darts” making final decisions on investments and often resemble that remark. Just as I am able to share in the reward of outperformance, I am to blame during years of underperformance. Since my firm’s founding almost two decades ago, I remain proud of our performance – though more proud that we have led our clients through exceptionally difficult markets while enabling them to remain retired.

2.) Our attached performance over the past decade for our clients illustrates that our performance has remained in line with some of the world’s finest money managers. More importantly, from my perspective is that we provide twice the income of most managers enabling our clients to withstand the inevitability of market sell-offs.

As value investors, there will be times in which we are 4 or 5 star rated and times in which we are 1 or 2 star rated. My goal has always been to attempt to equal the mean/average return while providing sound risk adjusted returns with above average income. To this end, we have been successful.

3.) “Beating a benchmark” is a fool’s errand. What benchmark are we to beat among the thousands available? What good does it do to outperform a benchmark by 1% if the benchmark is down 20%? More importantly, your investing should be goals driven rather than beating some arbitrary index.

4.) You, our clients, and I will always be concerned when experiencing losses. However, price declines are a natural and healthy aspect of investing. The short-squeeze currently occurring in energy and materials companies has such sectors rallying exceptionally strongly over the past month. Fools chasing momentum on the up or down side are getting hammered right now as they whipsaw from position to position.

5.) Why would you move to cash if Bernie is the nominee (not even elected President) after having survived almost eight years under Obama in which the economy and market have slowly improved? Great American companies will continue to grow regardless of idiotic politicians – even should our nation move toward a European socialism. Terrific international companies such as Nestle, Royal Dutch Shell, Diageo, etc. have performed exceptionally well under socialism as capitalism will find an outlet somewhere in the world in which these companies may flourish. As a patriot, I am concerned where our nation is headed. However, as a capitalist, I don’t let my political opinions influence our investments understanding innovative companies will thrive somewhere in our global economy. As I often state at our investment committee meetings: “What impact does a Bernie victory (or any other exogenous event) have on how many McDonald’s hamburgers are consumed in China, Nestle chocolate or Intel chips in Latin America or Pepsi soda (Frito Lay chips) in Africa or India?”

6.) When taking risk, we will always have defaults and investments which don’t perform well. Understanding I can often make “monkey” mistakes, we manage risk by not investing a large amount in any one position and never utilize leverage. Fortunately, I don’t have to be right 100% of the time in order to attain a sound rate of return. Though our bond portfolio lost 15.3% in 2008 (our attached Global Income balanced lost 24.9%), it attained a 36.8% return the following year. In a previous email, you asked when your bond portfolio would recover and I answered it would be impossible to determine if and when a recovery would occur as we could have a quick recovery, slower recovery and more or less defaults depending on many factors.

I truly believe that your moves into and out of cash our exceptionally harmful to your health – and wealth. It is for this reason that I displayed the timing of your recent emails and would recommend doing everything possible to avoid watching news channels (particularly Fox and CNBC) as study after study has displayed that investors perform poorly when acting on short term news. Better to enjoy a good economic or history book or if you must to at least enjoy the political season for the circus it is!

Hang in there and take care.

With warmest regards,

Jim