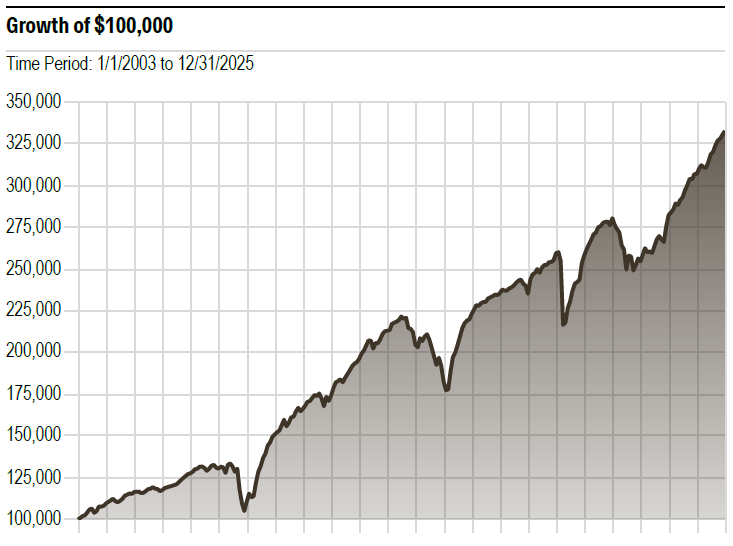

Strategy Inception: January 1, 2003

Portfolio Manager: Zac Q. Smith

Yield to Maturity: 5.96

Number of Holdings: 131

Average Credit Quality: BB-

Firm Assets: $676 million

Benchmarks: iShares Core US Aggregate Bond ETF, iShares iBoxx $ High Yield Corp Bd ETF

- Top-down strategy focus on yield curve positioning, sector rotation, duration management and credit risk management.

- Bottom-up selection process derived from our proprietary fundamental analysis of income statement and cash flow generation seeking issues with above average income potential.

- Invests primarily in U.S. dollar-denominated investment grade and high yield corporate issues.

- Risk Premium Management – pursues an attractive yield spread relative to a five year treasury within acceptable levels of portfolio risk.